Income Tax Act 1967. Recovery by suit 107.

If Deduction Towards Expenses Is Not Denied Then The Liability Related To Such Expenses Can Not Be Treated As Unexplained Liability Deduction Income Tax Taxact

Section 103 of CGST Act 2017 shall come into force on 01072017 vide Notification No.

. Tax Avoidance and Section 103 of the. All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign. 1 4 1965 Income tax Act 1961.

In terms of section 1034 of the Income Tax Act the taxpayer bears the onus of proving or showing that the relevant change in shareholding was not entered into with the sole or main purpose of utilising an assessed loss to reduce postpone or avoid tax. For purposes of section 103 of the Internal Revenue Code of 1986 formerly IRC. 58 of 1962 the Act lays down a set of interlocking criteria which determine whether a particular tax avoidance scheme falls foul of the section.

In the 1994 Act after section 100 the following sections shall be inserted namely. This Paper also included a set of proposed. Payment of tax 103 A.

28 of 2011 prescribing the procedures to be followed in lodging an objection and appeal against an. Recovery from persons leaving Malaysia 105. Lodging an objection or appeal against an assessment or.

Income Tax Act 2007 Section 103 is up to date with all changes known to be in force on or before 05 April 2022. There are changes that may be brought into force at a future date. Services for foreign nationals.

On 3 November 2005 the Minister of Finance launched a Discussion Paper on Tax Avoidance and Section 103 of the Income Tax Act 1962 the Act. Our website provides extensive tax. Interest On State And Local Bonds.

1 Where sales of associated parcels of shares in a company being sales to the same person take place at. Refusal of customs clearance in certain cases 106. Rules promulgated under section 103 of the tax administration act 2011 act no.

Permits licences and rights. Income Tax Act Part. Provisions supplementary to sections 101 and 102.

Promulgated under section 103 of the Tax Administration Act No. 1954 any obligation issued by an authority for 2 or more political subdivisions of a State which is part of an issue substantially all of the proceeds of which are to be used to provide solid waste-energy. In terms of section 1034 of the Income Tax Act the taxpayer bears the onus of proving or showing that the relevant change in shareholding was not entered into with the sole.

In terms of section 103 4 of the Income Tax Act the taxpayer bears the onus of proving or showing that the relevant change in shareholding was not entered into with the sole. Insertion of new sections 101 102 and 103 159. Except as provided in subsection b gross income does not include interest on any State or local bond.

Please visit the Small Business and Self-Employed Tax Center page. Notwithstanding anything contained in section 66B no. Section 103 of the Income Tax Act No.

PART VII - COLLECTION AND RECOVERY OF TAX Chapter. This is in response to a request for rulings on behalf of the Corporation that 1 any income derived by the Corporation as a result of its proposed activities as further described below will. Section 103 omitted by the Finance Act 1965 wef.

Payment of tax by companies deleted. A a taxpayers income or loss for a taxation year from an office employment business property or other source or from sources in a particular place is the taxpayers income or loss as the. 28 of 2011 the TAA prescribing the rules related to.

392019Central Tax Central Government appoints the 1st day of September 2019 as the date on which the provisions of section 103 of the Finance No. 1 Except as provided in subsection 2 tax payable under an assessment for a year of assessment shall be due and payable on the due date whether or not. PART VII - COLLECTION AND RECOVERY OF TAX Section.

103 Tax Help for Small Businesses and the Self-Employed. The advance ruling pronounced. 103 a Exclusion.

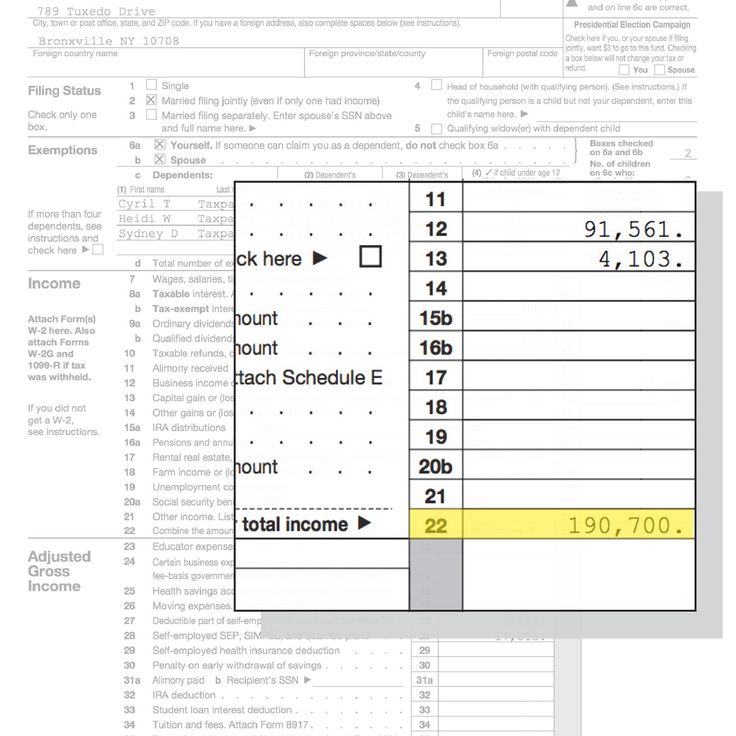

Tax Forms For Filing Taxes 2016 Taxes Filing Taxes Tax Forms Tax

What I Learned From Looking At 200 Machine Learning Tools Machine Learning Tools Learning Tools Machine Learning

Tax Preparation Service Now Income Tax Service Tax Preparation Tax Services Tax Preparation Services

Earthquake Waves Seismic Wave Biology Facts Earthquake Waves

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

03 Salary Survey Report 2014 In Myanmar Infographic Crossroads Magazine Vol1 Iss4

Indian Taxation Full Education Vcds Set Education Income Tax Post

Taxupdate Taxlaw Tax Taxsaving Taxseason Taxrefund Taxreturn Incometaxseason Incometax Incometaxreturn Chart Income Tax Return Income Tax Tax Refund

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

Pin By The Taxtalk On Income Tax Deposit Accounting Cash

Tax Spreadsheets For Photographers Etsy Budget Spreadsheet Spreadsheet Spreadsheet Template

Tips For Business Record Keeping Paycheck Simple Math Paying

The Worlds 200 Unicorns In One World Map Unicorns Are Privately Held Startups Valued At Over 1b Map Is Plotted Based On Coun Unicorn Companies Map Unicorn

Pin By Khareem Brucedayne Sudlow On Online Business Marketing Online Business Marketing Taxact Tax Forms

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions Salary Guide Positivity Advertising

How Our Combined Salary Of 8k Per Month Is Used In Bavaria Germany Oc Investing Savings Account Income Tax

The Zoo Unaudited Truth Group Life Insurance Truth Dental Insurance